- A bad omen for the stock market…

- The great debasement…

- “Dumb” money is buying stocks. But “smart” money is quietly shifting to a specific gold play. And a government meeting on October 29th could send this strategy stratospheric. Go here to learn what the smart money is planning — and how you can ride its coattails…

Dear Reader,

Since 1998… how much value has American wages lost — against gold?

Answer shortly. But first, we pause to reflect upon the present market delirium.

Two Fridays past, the Dow Jones Industrial Average plunged some 900 points.

Retail investors galloped in to “buy the dip.”

Do you harbor contrarian leanings? Then you should be girding for heavy weather.

That is because extreme dip-purchasing is not a bullish indicator. It is instead a bearish indicator.

A Warning Sign

Market commentator Mark Hulbert:

- According to data compiled by my colleague Joseph Adinolfi, [two Fridays ago] “saw the biggest total buying by the retail crowd since Jan. 27, 2021…

- This investor behavior is bearish, because willingness to buy market dips is a contrarian indicator: Market tops typically occur when investors treat dips as buying opportunities, according to contrarian theory.

- It’s just the opposite at bottoms, when investors refuse to believe that any rally is sustainable — therefore treating every uptick in the market as an occasion to sell more.

If it is evidence you seek… it is evidence you shall have:

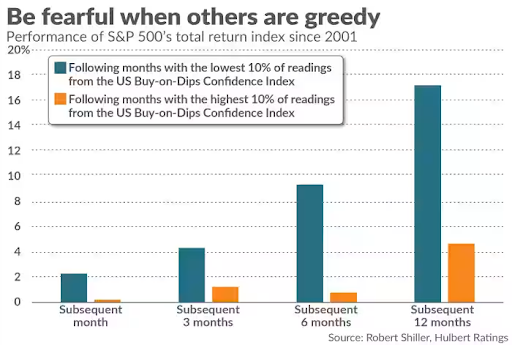

- Data compiled by Yale University finance professor Robert Shiller confirms this contrarian argument. Since 2001 he has been calculating a “Buy-on-Dips Confidence Index,” which measures the percentage of retail investors who believe that the stock market will rise the day after big drops.

- As you can see from the accompanying chart, the S&P 500 on average performs far more poorly following high index readings than low ones… there can be little doubt that it’s a bad sign that their rush to buy [this recent] dip is at a nearly five-year record high.

Be Fearful When Others Are Greedy

Here is the chart referenced:

Yet as I am fond to state, climate is what a fellow can expect. Weather is what he actually gets.

The foregoing does not forecast stock market weather. It merely suggests overall climatic conditions you may expect under present conditions.

And present conditions suggest a looming climate of turbulence — at least as history runs.

Back to Gold and the Dollar

Yet let us revisit today’s central question.

Since 1998… how much value has American wages lost — against gold?

Here I offer you choices. Is the answer:

A): 16%…

B): 39%…

C): 77%… or…

D): 87%?

Have you selected?

The correct answer is C. American wages have tumbled 77% against gold since 1998.

How do you like it? I hazard very little.

Yet the gentlemen and ladies of InvestorsObserver have executed the mathematics. And the mathematics is the mathematics.

The Anatomy of Dollar Decline

Here are their central findings:

- As of October 2025, American wages have lost 77% of their purchasing power against gold since 1998.

- The average American’s per capita income, measured in gold ounces, declined by roughly 70% from 1998 to 2024 – even as dollar salaries steadily rose.

- Between 2024 and October 2025, purchasing power in terms of gold has declined by an additional 20%.

In conclusion:

- These final years of the 1990s represented American workers’ last stand before the great devaluation began. Families could still reasonably expect their paychecks to provide genuine wealth-building opportunities, regardless of whether they lived in Connecticut’s affluent suburbs or Mississippi’s rural communities.

- The systematic destruction of this purchasing power over the following decades would prove to be one of the most consequential economic shifts in American history, transforming a nation of workers with real financial security into one where even modest asset accumulation requires extraordinary effort.

Politics Is Downstream of Economics

I believe there is justice in these comments.

It is no stretching of the facts to claim that the great debasement “would prove to be one of the most consequential economic shifts in American history.”

Would a Donald Trump have been elected United States president — twice — absent the great debasement?

I believe the answer is no.

Nor do I believe socialist theories would seduce so many youthful Americans absent the great debasement.

They feel as if they run in place… trapped upon the hamster wheel.

They believe capitalism has failed them.

Capitalism has not failed them — yet today’s distorted capitalism has failed them.

It is capitalism parading in false whiskers. And many cannot penetrate the disguise.

Behind the disguise we find the Federal Reserve itself.

The Honest vs. the Dishonest

This institution is the custodian of the United States dollar — the very dollar that has shed 77% of purchasing power relative to gold since 1998.

Thus the Federal Reserve has conducted a very poor custodianship of the nation’s currency.

Inert, idle gold does nothing but sit there… silent as the Sphinx… silent as the grave.

Gold plays no tricks. Thus gold is honest. And gold’s truth-telling embarrasses the Federal Reserve.

That is because gold exposes their dollar mismanagement.

For that precise reason they resent gold… as the dishonest fundamentally resent the honest.

I prefer the honest to the dishonest.

I prefer gold.

Regards,

Brian Maher

for Freedom Financial News