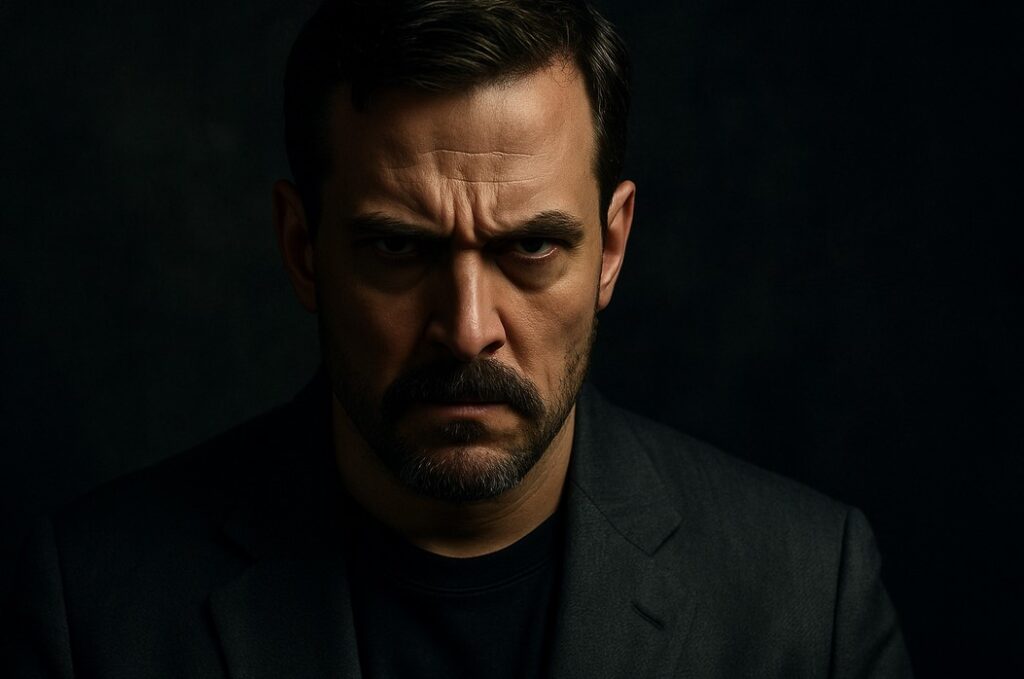

- Potentially the most dangerous man in America…

- A high stakes game with the dollar…

- Robert Kiyosaki’s new warning reveals the shocking truth about the economy they don’t want you to know. Don’t be left behind. Click here to get his urgent action plan now!

Dear Reader,

Is this bookish and owlish fellow — harmless as sheep to all outward appearances — the most dangerous man in America?

His name is Mr. Stephen Miran.

Mr. Miran presently chairs the Council of Economic Advisers, upon nomination by President Trump.

The same President Trump has nominated him for service upon the Federal Reserve Board of Governors.

The Banking Committee of the United States Senate is scheduled to consider his nomination next week.

Why This Guy?

Let us now tackle the question dangling in the air:

Why is this unlikely fee-fi-fo-fum potentially the most dangerous man in America?

After all, he harbors no terroristic ambition, wields no weapons and has never been jugged.

To my knowledge, he is not an agent of Vladimir Putin. He is against the devil and the man-eating shark.

Yet as Stansberry Research explains:

- A 41-year-old economist with sweeping new powers in the White House – may be “the most dangerous man in America”…

- Recently appointed as chair of the White House Council of Economic Advisers, Miran has authored a secretive 41-page blueprint for U.S. trade and monetary policy.

- In it, he argues the U.S. must drastically weaken the dollar to fix economic imbalances. Though unknown to most Americans, Miran’s behind-the-scenes influence on President Donald Trump’s team is why (Stansberry Research’s) Dan Ferris calls him “the most dangerous man in America.”

- Miran is “no simpering bureaucrat,” Dan [says] – “he’s a revolutionary” with a plan to “reset” the monetary system. This plan is spelled out in a document Miran authored in November 2024, titled “A User’s Guide to Restructuring the Global Trading System.”

Resolving Triffin’s Dilemma

In the referenced document, Mr. Miran argues that:

The United States dollar — being the world’s premier reserve currency — artificially fortifies that dollar.

And that fortified United States dollar enfeebles American industry.

The result is an unsustainable trade imbalance with the world’s productive nations… and himalayan United States debt.

Mr. Miran seeks to overturn the arrangement. He seeks nothing less ambitious than a complete monetary “reset.”

Through this dollar reset he seeks to resolve “Triffin’s Dilemma.”

Stansberry Research:

- At the heart of Miran’s plan is a recognition of the Triffin Dilemma, a structural contradiction in a dollar-dominated global economy.

- Because the U.S. dollar is the world’s reserve currency, America must supply the world with dollars by running large deficits… that is, buying more from abroad than it sells.

- Over decades, this has overvalued the dollar and hollowed out U.S. manufacturing.

- Miran and Trump’s team believe a controlled devaluation would correct these imbalances — bringing factories and jobs back to the U.S….

- One outcome of devaluing the dollar is that U.S. debts would shrink in real terms. The U.S. owes trillions of dollars to both domestic and foreign creditors. If the dollar’s value drops 30%, effectively those debts are 30% “cheaper” to pay off in real terms, because dollars are worth less…

- Trump’s officials have been unusually candid about their intentions. In mid-2025, Treasury Secretary Bessent publicly hinted, “We are going to have to have some kind of a grand global economic reordering, something on the equivalent of a new Bretton Woods.”

A 30% to 40% Drop in the Dollar?

At the center of the potentially dangerous man’s plot is a “Mar-a-Lago Accord,” so-called.

- The Mar-a-Lago Accord is essentially a shorthand for a potential international agreement to jointly devalue the U.S. dollar. It’s directly inspired by the Plaza Accord of 1985, when the U.S., Japan, West Germany, France, and the U.K. struck a deal to weaken the dollar.

- In today’s context, the idea would be to gather key economic powers — likely including the U.S., European Union, Japan, U.K., and perhaps China — to agree on steps to reduce the dollar’s exchange rate versus other major currencies…

- The Plaza Accord led to roughly a 30% to 40% drop in the dollar’s value over two years… For today’s context, the Plaza Accord is practically a template. It shows that the U.S. government is willing to devalue the dollar when it’s deemed too strong…

- Trump’s policies on tariffs, jawboning the Fed to be more dovish, and renegotiating trade deals all feed into a strategy of reducing the dollar’s value and resetting trade relationships…

- While not yet official, signs point to such a deal emerging soon — possibly this year.

Just so. Yet why is this Miran fellow so potentially dangerous?

“Potentially” is a necessary qualification.

That is because Stansberry Research concedes that, “If they succeed, it could usher in a new era where U.S. factories hum again and debts shrink in real terms.”

On the Other Hand…

Yet if they do not succeed?

- The “danger” in Miran being “the most dangerous man” is not that he intends harm… It’s that his radical solution involves massive risks…

- If they miscalculate, the risks are immense: a loss of confidence in the dollar, runaway inflation, or a market crash…

- Following Miran’s roadmap means “juggling dynamite”… because if the dollar reset goes wrong, it could trigger a financial explosion…

- Stocks could face violent drops, and dollar-based assets like cash or U.S. bonds would lose significant real value… The urgency in the narrative is clear: Investors sitting on too much cash or overpriced U.S. stocks risk severe losses…

Not even the plan’s mastermind is convinced of its genius:

- Miran himself acknowledges uncertainties. He reportedly ends his own paper by conceding that success is not guaranteed — a rare admission for a policy architect. This humility doesn’t comfort investors much, however, since it means even the plan’s creator knows he’s playing with high stakes…

Playing High Stakes With the Dollar

How high are those stakes?

- Miran’s rise from obscurity to power is a signal: The U.S. government is embarking on a very different economic path — one that could dramatically affect currency values, trade, and, by extension, the stock and bond markets…

- This dramatic step is aimed at resetting the global economic order… but would likely severely erode Americans’ cash savings and buying power if it comes to pass… the big-picture takeaway is that we are likely on the cusp of a deliberate dollar devaluation, something not seen in decades…

- The financial world as we know it could soon change dramatically.

Any “Mar-a-Lago Accord” — or variation thereof — can only transpire with a cooperative Federal Reserve consecrated to a weaker dollar.

That, I hazard, is why the president is so keen to replace “Too Late Powell.”

It is why he is keen to embed his cheap-dollar men within the Federal Reserve.

Is the dollar in for a severe devaluation? Will a Mar-a-Lago Accord materialize?

I do not know… yet the ducks are evidently lining in a row.

Perhaps the time to acquire gold is now.

Brian Maher

for Freedom Financial News