- The Fed cuts, but disappoints Wall Street…

- Jerome Powell’s ideal successor…

- From the desks of President Trump and Robert Kiyosaki… this book isn’t available anywhere else. That’s unfortunate for most Americans. The good news is you can get a copy. Go here to see why it’s so important — and exactly how you can get your hands on it.

Dear Reader,

The Dow Jones Industrial Average was up and away 334 points yesterday afternoon.

As widely expected, the Federal Reserve had proceeded with its 25-basis point rate reduction.

All was peace.

Yet at half past two, the index promptly plummeted earthward.

Within minutes it had reeled some 365 points.

The index rediscovered its footing… and ended trading 74 points in the crimson. What set off the initial cascade?

Mr. Powell opened wide his mouth… and talked.

He said it is far from certain the Federal Reserve would enact an additional rate reduction in December — a rate reduction for which Wall Street had yearned.

Far From Certain

Reports CNBC:

- The Fed lowered its benchmark overnight borrowing rate by a quarter percentage point at the conclusion of its two-day policy meeting Wednesday, putting it in a range of between 3.75% to 4%. This marks the second time this year that the central bank has slashed rates. Prior to the decision, investors were betting on another quarter-point cut at the Fed’s December meeting.

- But Powell knocked down market expectations after saying that there were “strongly differing views about how to proceed in December” during this meeting’s committee discussions. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it,” he said.

And so Wall Street shed its previous verve, its vivacity, its vim.

Dissension in the Ranks

Yet why did Mr. Powell empty ice water upon Wall Street’s collective head?

In the informed opinion of a certain Michael Rosen, chief investment officer with Angeles Investments:

- Powell is reflecting the tension on the Fed between those who favor more aggressive easing and those who are concerned that inflation remains too high, even as the labor market weakens.

- Our view has been that the market has been too aggressive in pricing in the pace and magnitude of future cuts. Inflation is elevated above the Fed’s target, and we see monetary policy as moderately loose, with nominal rates below nominal GDP growth.

The fellow cites internal Federal Reserve tension — correctly.

Two members of its Federal Open Market Committee voted nay on the 25-point reduction.

One was against any rate reduction whatsoever. The second insisted upon a 50-point reduction.

Stagflation Ahead?

Adds Ms. Diane Swonk, KPMG chief economist:

- We are going to see a lot of tension going forward because this is a really difficult time. One, we’re flying blind. Two, inflation is up and unemployment is edging up as well, and the labor market is slowing.

- You add all of that together and you get this sort of stagflation width, which is what makes this Fed likely to have more dissents that go in both directions going forward.

As Mr. Powell himself argued yesterday:

“Risks to inflation are tilted to the upside, and risks to employment are tilted to the downside.”

Does not elevated inflation risk… twinned with downward employment risk… write the very recipe for stagflation?

Regardless, if Wall Street sulked at the diminished prospects of a December rate reduction yesterday… Mr. Powell delivered it a highly toothsome consolation gift.

Powell Announces End of QT

Yesterday he declared the end of quantitative tightening, so-called. The business will cease on Dec.1.

And so the Federal Reserve will free the liquidity kinks presently in place — to the extent that they are in place.

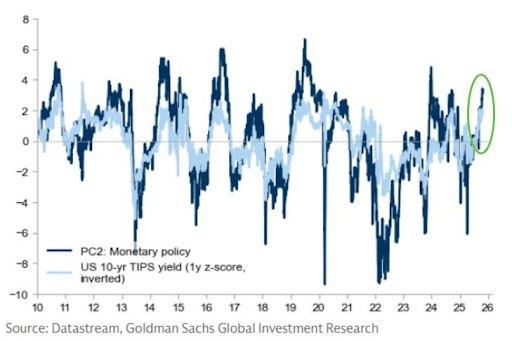

Goldman Sachs reports that financial conditions are very substantially loose as is.

As loose, if you will allow me, as a streetwalker’s virtue:

In spite of its quantitative “tightening,” the Federal Reserve’s balance sheet swells to $6.6 trillion — some $2.6 trillion above its pre-plague level of roughly $4 trillion.

Prior to the Great Financial Crisis, the Federal Reserve’s balance sheet guttered along at $875 billion.

What is the phrase? You can never go home again?

Oh, Boy

Meantime, Mr. Powell was asked if he feared an artificial intelligence bubble similar to a technology bubble in the late 1990s.

His answer converted my spine to an icicle… and my blood to sea ice:

“It’s really a different thing.”

As I have written before:

“This time is different,” runs the eternal refrain. And it always is different — in the particulars.

A dot-com boom is not a housing boom is not an artificial intelligence boom.

It is these particulars that fox and deceive. It is why many believe this time is different — including chairmen of the Federal Reserve.

Yet because they believe this time is different… is precisely why this time is the same.

This Man Should Succeed Powell

Mr. Powell’s tenure ends next May. Crackerjack economics commentator Mike “Mish” Shedlock has volunteered to succeed him.

If nominated, he proposes to:

- Explain to the nation why we don’t need a Fed and how independent central banks have created boom-bust cycles of increasing amplitude over time.

- Surround myself with qualified insiders who understand the Fed but also believe in the mission to end the Fed.

- Stop paying interest on reserves, phased in over 18 months.

- Wind down the Fed’s balance sheet totally in 2-3 years.

- Require that assets available on demand such as checking and savings accounts are truly available on demand. That means demand deposits are parked in overnight US treasuries. This would be phased in over two years. As a result, we would have genuine safekeeping banks.

Essentially, I intend to wind down the Fed orderly, then fire myself.

I cannot conceive of a worthier candidate to chair the Federal Reserve.

Here you have a man whose self-termination represents his crowning victory.

Here you have the ideal public servant.

Thus I forward his application for President Trump’s earnest consideration.

Alas, I fear he will empty the file into his hellbox.

He is not the president’s man.

Regards,

Brian Maher

for Freedom Financial News