Pay attention…

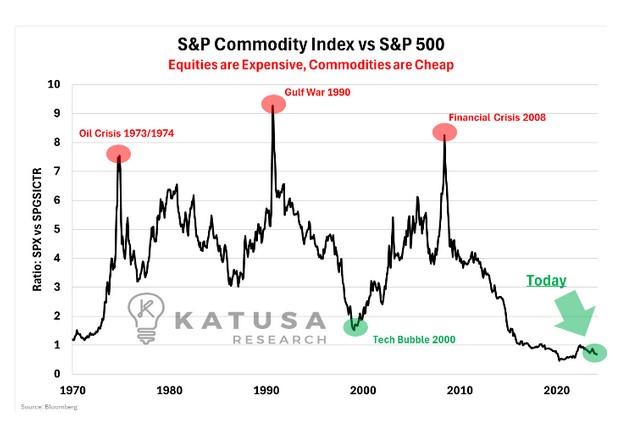

This is the single most important chart in the world right now.

IF this is the beginning of a MAJOR move upwards, commodities are about to get very expensive…

Commodities are the cheapest they have ever been compared to the S&P 500. There’s nowhere to go but up.

And that’s despite certain commodities that have caught nearly every investor off guard.

- Copper has risen 11% year to date and 25% over the past 3 years (and is gunning for record highs).

- Silver has spiked 18% year to date and is at 11-year highs.

- Uranium is up and my biggest uranium holding is up nearly 2,000% from its March 2020 lows.

But the silent bull market the average investor isn’t seeing, is GOLD.

Gold Could Go Vertical, Fast

You might be thinking, “Yeah, but it feels like gold is already pretty high at $2300/oz.”

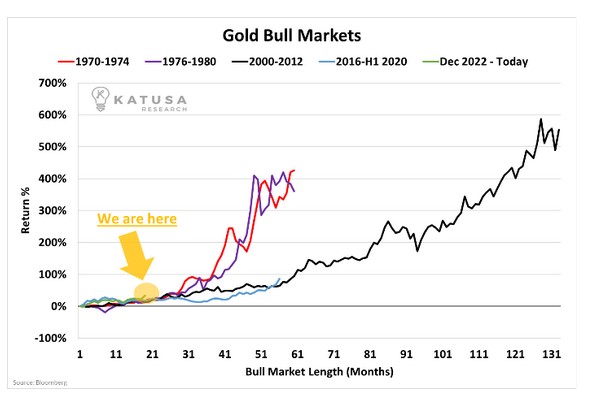

If you’ve been following precious metals for a long time, one thing’s for sure, the gold market has always moved in cycles. Going from dramatic boom to overnight bust, and eventually back again.

So far in this “boom,” gold has moved 46 percent from its floor. We are clearly in the next phase of the Gold Bull Market.

- From 1972–1974, gold rose from $45.75/oz to $183.85/oz. Yielding a gain of over 300%.

- From 1978–1980, gold rose from $169/oz to $589/oz. Good for another 250% gain.

- Then from 2007–2010, another 123% gain.

Where Are We Today?

The chart below shows gold’s major bull market cycles since the 1970s.

As you can see from the chart, when gold is ready to rise, it takes off.

“Gold is in An Unshakeable Bull Market”

Gold has broken out – with fury – from the range it was stuck in since the highs of 2020.

According to MarketWatch: “Goldman Sachs says it’s the beginning of a structural bull market in commodities.”

Following up on that, Goldman just came out the other day stating “Gold is in an unshakeable bull market”.

My take? I rarely, if ever, agree with mainstream finance.

But in this case: We are still very, very early in this gold and resource “supercycle” market, the likes of which the world has never seen before.

With gold prices spiking in short order the past 2 weeks, it has more than just regular precious metals investors paying attention.

Checking around with different gold dealers for actual bullion, it’s difficult to find gold eagles or maples. And if you do, be prepared to pay a significant premium on top of the current spot price hovering above $2375 per ounce. We’ve seen some dealers charging well over $2,800 for a one-ounce gold coin.

The #1 Way to Make Money in Gold

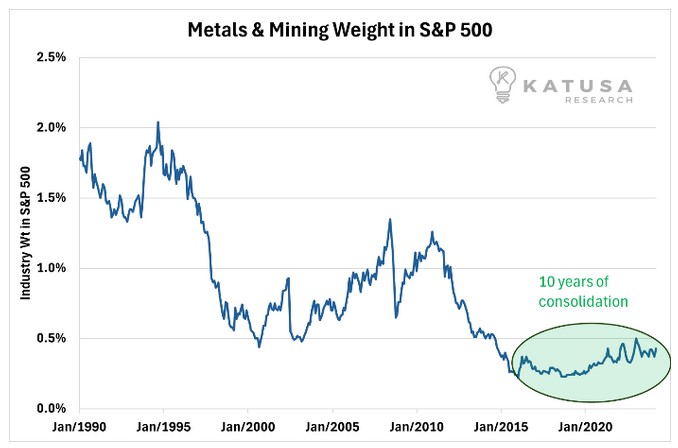

At the end of the Cold War, there were 20 mining companies in the S&P 500. Today there are only 2.

The flow of capital into the mining space has been challenging for most. The sector is unloved, and capital-starved. This is great for investors.

Sure, you could buy gold bullion…

It’s independent of government-controlled financial systems. Your money will be relatively protected from the currency wars.

Sure, you could buy gold-backed ETFs, they offer a little more leverage, and can give you some quick profit when gold starts to rise. But when gold starts going up, gold stocks tend to go up a lot. And the gold stocks have not made their big moves yet.

In the Coming Days…

You’ll find out why I love this corner of the resource market and show you examples of the high-risk, high-reward nature of gold stocks.

What’s coming next could be the perfect recipe for gold.

The Fed is planning their next moves, which could have drastic consequences on the economy and continue to have significant impacts on the gold price.

Most people aren’t noticing…

Yet certain big investors are making major bets on gold, myself included. But I’m not throwing darts at a board…

I’m going for the bulls-eye. This stock was the #1 performing gold stock in the last gold bull market.

Regards,

Marin Katusa

Contributor, Freedom Financial News