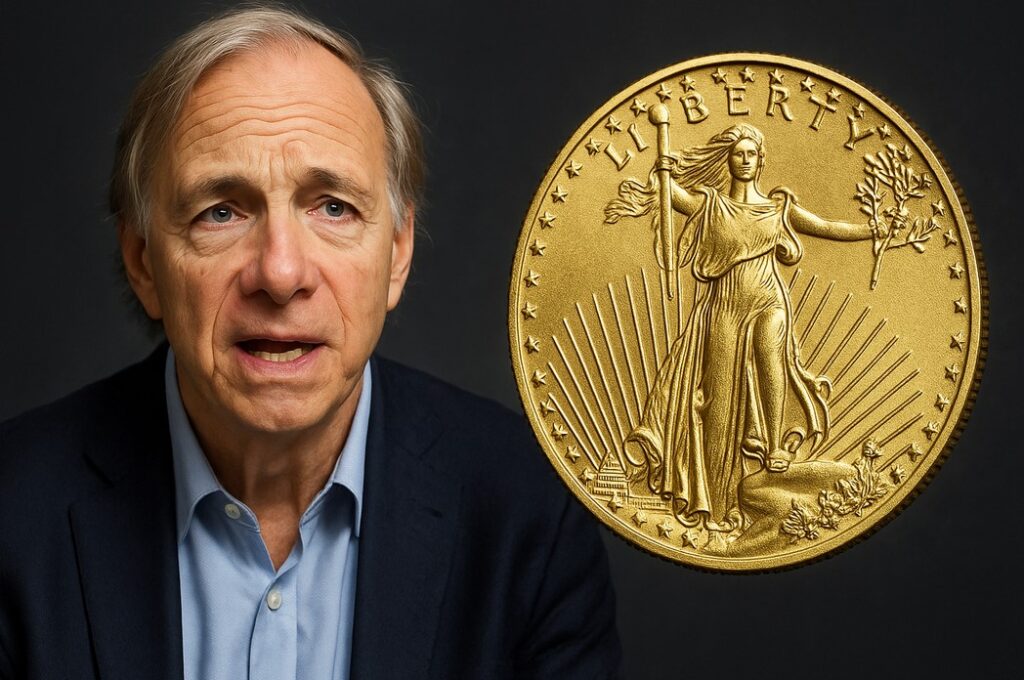

Ray Dalio just said something most people need to hear.

Gold isn’t a metal. It’s money.

The most established form of money. The most sound money.

And he’s right.

For thirty years, I’ve been saying the same thing. Gold is real money. Fiat currency is fake money.

Now one of the world’s biggest investors is saying it too.

Maybe people will finally listen.

- Discover why Ray Dalio—one of the world’s most successful investors—says gold isn’t a metal, it’s money, and why he recommends 10-15% of your portfolio in gold right now.

- Learn why 80% of all currencies since 1750 have disappeared and the other 20% have been severely devalued—while gold has survived and thrived as the ultimate settlement asset.

- Find out about the gold income secret that’s 11 times more profitable than buying the metal—and why Ray Dalio, central banks, and the smart money are positioning for this shift right now. Click here to discover what they already know.

The Mistake Everyone Makes

Most people think of gold as a metal. A commodity. Something shiny you put in a vault.

They think of fiat money as real money. Dollars. Euros. Yen.

That’s backwards.

Fiat money is debt. It’s a promise. A piece of paper that can be printed into oblivion.

Gold is money. Real money. Money that can’t be printed. Money that can’t be devalued.

Ray Dalio understands this. He’s studied the debt-gold-money cycles that have occurred in almost all countries over almost all time.

And here’s what he knows: When debt bubbles pop, when fiat money gets printed to prevent defaults, gold becomes the most valued asset.

It’s not a theory. It’s history.

Gold Settles Transactions

Here’s what Ray said that really matters.

Gold is money like cash. But unlike cash, it settles transactions without creating debt.

Think about that.

When you use a dollar, you’re using debt. Someone owes someone else. The whole system is built on IOUs.

When you use gold, the transaction is settled. Done. No debt. No promises. No counterparty risk.

That’s why central banks are buying gold at record levels. That’s why the BRICS nations are dumping dollars for gold.

They understand what Ray understands. What I’ve been teaching for decades.

Gold is the ultimate settlement. The final payment.

You’ll Hate Yourself After October 29th If You Ignore This Message.

While the talking heads on TV are telling you to buy gold, a small circle of insiders is preparing for an 11X windfall. A critical government meeting on October 29th will be the catalyst. Don’t be the one left on the outside looking in.

Discover The 11X Gold Strategy They Don’t Want You To Know About. Click Here Now.

Why Not Silver or Bonds?

People always ask: Why gold? Why not silver? Why not inflation-indexed bonds?

Ray answered this perfectly.

Silver and platinum are good inflation hedges. But they don’t have the same historical and cultural significance as gold.

Silver is influenced by industrial demand. More volatile. Platinum is even more constrained.

Neither has the universal acceptance of gold.

As for inflation-indexed bonds? They’re still debt. They’re tied to government creditworthiness.

And here’s the kicker: Governments rig the inflation numbers. They change the terms. History shows this happens every time there’s high inflation and high debt.

The neo-Marxists and globalist backers want you in bonds. They want you dependent on their rigged system.

Gold doesn’t depend on anyone. It has intrinsic value. It’s no one’s liability.

The AI Bubble

Ray also talked about AI stocks. The massive upside. The enormous potential.

But he’s not blind to the risks.

AI stocks account for 80% of U.S. stock market gains. The top 10% of income earners own 85% of stocks. AI companies’ capital expenditures account for 40% of this year’s economic growth.

If the AI boom doesn’t deliver, the downturn will be catastrophic.

For people’s wealth. For the economy.

Ray’s bubble indicator is flashing warning signs. He’s not saying AI is definitely a bubble. But he’s saying diversification is prudent.

I’ve been saying the same thing. The AI boom is built on debt. On speculation. On hope.

When it pops—and it will—you need to be protected.

That’s where gold comes in.

How Much Gold Should You Own?

Ray recommends 10-15% of your portfolio in gold.

Not as a tactical bet. As strategic asset allocation.

Because gold has negative correlation with stocks and bonds. When stocks and bonds do badly, gold does well.

It’s insurance. A diversifier. A safety net.

Since 1750, about 80% of all currencies have disappeared. The other 20% have been severely devalued.

Gold has survived. Gold has thrived.

That’s not luck. That’s the nature of real money.

Gold Is Replacing Treasuries

Ray was asked: Has gold begun to replace U.S. Treasuries as the riskless asset?

His answer: Yes.

Central banks are decreasing Treasury holdings and increasing gold holdings.

Gold is now the second-largest asset held by central banks.

Why?

Because debt assets are commitments to deliver money. Sometimes that money was gold.

Sometimes it was fiat money that could be printed.

When there’s too much debt, central banks print money to pay it back. This devalues it.

Gold doesn’t have that risk. It’s intrinsic value. It doesn’t depend on anyone’s promise.

History shows the biggest risk is that debt assets like Treasuries will be defaulted on or devalued.

More likely devalued.

Gold is timeless. Universal. Real.

The Shift Is Happening

For thirty years, I’ve been fighting the neo-Marxists and globalist backers who want you trapped in their fiat system.

Now Ray Dalio—one of the most successful investors in history—is saying the same thing.

Gold is money. Fiat is debt. The shift is happening.

Central banks know it. Institutional investors know it. The BRICS nations know it.

The question is: Do you know it?

And more importantly: Are you positioned for it?

Ray recommends 10-15% in gold. I’ve been recommending gold, silver, Bitcoin, and real estate for decades.

Real assets. Not paper promises.

The choice is yours. But the evidence is overwhelming.

Gold isn’t a metal. It’s money.

The most sound money. The most established money.

And it’s time you treated it that way.

Robert Kiyosaki

for Freedom Financial News