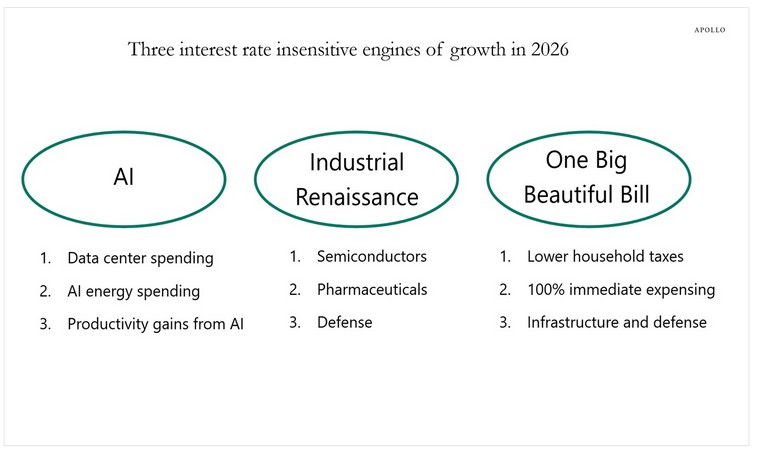

- Three engines of economic growth…

- The case against the positive case…

- Have you heard of the “Presidential Bypass”? It’s a legal loophole the rich use to keep their money. And though you might not know it, you can use the same exact loophole to slash your taxes.

Dear reader,

Mr. Torsten Slok is Chief Economist and Partner at Apollo Global Management.

He believes the year 2026 will be a year of rambunctious economic growth… a year of plenty:

- It is very difficult to be bearish on the US economic outlook, and later this year the conversation in markets will change from talking about Fed cuts to instead talking about the Fed having to hike.

I do not believe the president will partake of that conversation. He is convinced existing interest rates range far above their proper level.

And if Mr. Powell’s presumptive successor — Kevin Warsh — fails to reduce interest rates this year, the president will train his cannons upon him.

Instead of “Too Late Powell,” the president’s new slur will be “Wrong Way Warsh” or some such.

The Three Engines of Economic Growth

Yet why does this Slok fellow beam with such confidence in the economic outlook?

The answer reduces to a lovely trio — Artificial intelligence, reinvigorated industry and the president’s “Big, Beautiful Bill”:

Adds Mr. Slok:

- US GDP growth is accelerating because of the One Big Beautiful Bill, the AI boom and the ongoing industrial renaissance. As a result, inflation pressures are building, driven by higher wages, higher commodity prices and a weaker dollar…

Just so. Yet consider a run of recent headlines…

Poor Economic Omens

From The Wall Street Journal:

U.S. Job Openings Hit New Post-Covid Low

Claims Fortune:

Top economist says latest jobs data shows a ‘jobless expansion’ with no historical precedent — and it’s ‘gut-wrenching’ for the middle class

The Daily Mirror reports that:

Trump economy tanks as layoffs hit highest January level since 2009

Meantime, Money Talks News claims that:

Grocery prices just saw the largest monthly spike in 3 years

“While the price of eggs has plummeted,” the article continues, “costs for dairy, bread, and beverages continue to climb for American families.”

Conflicting Visions

Thus we have two… conflicting… visions of the economic outlook.

One crystal-gazing has the United States economy up and away on the rising thermals of artificial intelligence, industrial resurgence and government stimulus.

The other crystal-gazing has the United States economy wallowing in a sort of recessionary twilight… with an inflationary component mixed into the bargain.

Which account is right? Which account is wrong?

As is generally the case, I do not know. Yet I confess to a certain bias.

I tend to observe glasses that are half empty of liquid — not half full of liquid.

Silver linings are gray edges and bright sides are usually the wrong sides.

Yet again, I harbor a bias that shades my view of the world.

And I concede it at once: the facts — seen in their true aspect — may run 180 degrees the other way.

The glass may indeed be half full of liquid. And the silver lining may be authentic silver.

Are They Really Engines of Growth?

Yet let us consider, briefly, Mr. Slok’s three engines of economic salvation. First, artificial intelligence.

Mr. Slok cites productivity gains issuing therefrom. I do not question that artificial intelligence may vastly elevate economic productivity.

Yet as I reported recently:

The Massachusetts Institute of Technology recently conducted a study, “The State of AI in Business 2025,” by title. From which:

- Despite $30–40 billion in enterprise investment into GenAI, this report uncovers a surprising result in that 95% of organizations are getting zero return… Just 5% of integrated AI pilots are extracting millions in value, while the vast majority remain stuck with no measurable P&L (profit and loss) impact.

More:

- Despite high-profile investment, industry-level transformation remains limited. GenAI has been embedded in support, content creation, and analytics use cases, but few industries show the deep structural shifts associated with past general-purpose technologies such as new market leaders, disrupted business models, or measurable changes in customer behavior.

“Workslop”

Meantime, we learn that human energies are not often liberated by artificial intelligence.

They are instead chained down by artificial intelligence. That is because humans must correct artificial intelligence’s frequent botchwork.

Artificial intelligence can add two and two, it is true. Yet artificial intelligence cannot put two and two together.

Do you see the difference? Thus artificial intelligence will fabricate images of female popes and the like.

From that perspective, artificial intelligence has proven more anchor than wing.

What results is corporate “workslop.”

Harvard Business Review:

- Employees are using AI tools to create low-effort, passable looking work that ends up creating more work for their coworkers.

- On social media, which is increasingly clogged with low-quality AI-generated posts, this content is often referred to as “AI slop.”

- In the context of work, we refer to this phenomenon as “workslop.” We define workslop as AI generated work content that masquerades as good work, but lacks the substance to meaningfully advance a given task.

- Employees who have encountered workslop estimate that an average of 15.4% of the content they receive at work qualifies… Workslop occurs across industries…

Is this the model of economic productivity?

Not so Fast

Meantime, Mr. Slok cites an industrial renaissance of, I presume, onshored industries.

I am not against the onshoring of industries. Yet it is more a long-term prospect than a short-term push.

Facilities must be constructed. New supply chains must be linked together. Employees must undergo training, at times extensive training.

Regulation upon regulation extends the timeframe. All the while, businesses cannot be certain that a future administration will undo the president’s initiatives.

I believe the phrase is “regime uncertainty.” Thus businesses may postpone prospective relocation.

The Big, Beautiful, Debt-Inducing Bill

Next we come to 2025’s “Big, Beautiful Bill” Mr. Slok cites. He believes it is an agent of growth. Perhaps in certain respects it is.

Yet the Congressional Budget Office projects the thing will pile $2.3 trillion upon the federal budget deficit across 10 years.

The Committee for a Responsible Federal Budget — do not laugh! — estimates it will contribute some $3.3 trillion to the nation’s debt across the same space.

Perhaps they will be proven mistaken. Yet I am far from certain they will be.

Meantime, Mr. Slok claims defense expenditures will kindle economic productivity.

Yet if military expenditures prod economic growth… why was the Soviet Union an economic wasteland?

They spent heaps and heaps upon military wares of various sorts. What precisely did it stimulate but a general privation?

Keynesianism is Keynesianism — be it left-wing Keynesianism or right-wing Keynesianism.

The Evil of Hope

In all, I am far from convinced that 2026 will be a year of expanding plenty.

I hope that it will be of course.

Yet I am fond to cite Herr Nietzsche. The stern, dour Teuton argued that:

“Hope… is the worst of all evils because it prolongs the torments of man.”

Thus I prefer despair to hope.

That is because despair does not prolong our torments.

It merely affirms them.

Brian Maher

for Freedom Financial News