- The industrial sector remains in a difficult spot

- U.S. inflation stays sticky, when will there be some relief?

- Real wages take another hit

Dear Reader,

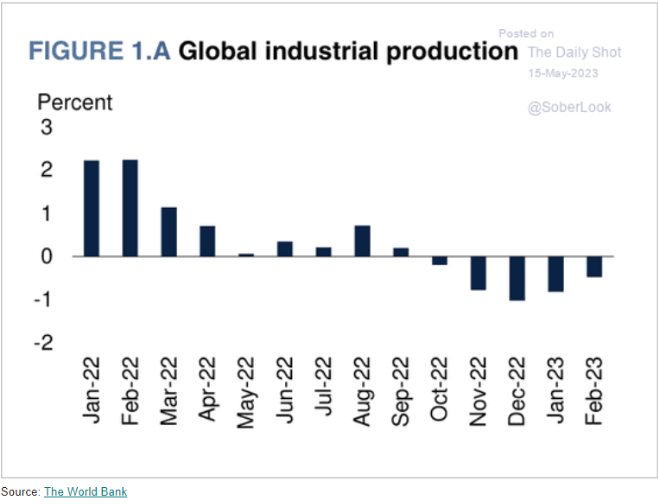

When we turn to the global economy, the industrial sector remains in a difficult spot with more pressure coming down the road.

- April global manufacturing PMI was down two tenths of a point to 48.7, below the 50 threshold for the 8th consecutive month

- EM Asia ex-China is one of the only regions to accelerate over the month (+0.5pt to 52.7)

- 30% of countries stay in expansion (>50) of which 9% are slowing down and 21% are accelerating, Thailand the most

- 18% are recovering, including the US & Japan √ 52% deteriorating, Italy the most

The slowdown in the industrial sectors is starting to hit the emerging markets in a much bigger way, as rates remain elevated and inflation stays sticky on a global level.

U.S. Economic Pressure Still Center Stage

The U.S. economic pressure is still center stage as leading indicators still show cracks as inflation stays sticky.

“Leading Economic Index from the Conference Board fell by -0.6% m/m in April, taking the year/year trend further into negative territory … -8% decline consistent with prior recessions going back to 1960s.”

Here is another way to look at the data:

“April marked 13th consecutive month of monthly contractions for Leading Economic Index from @Conferenceboard … going back in history, only two recessions have reached at least 13: those that started in 1973 and 2007.”

Even as the pressure on leading indicators mount, inflation pressure is still persistent across large parts of the economy.

There is still broad pressure on pricing with over 75% of products in the market showing inflation over 4%.

Real Wages Take Another Hit

Real wages have been firmly negative for the last 25 months, and there is little chance that changes over the next several months.

Sticky inflation shows no signs of adjusting meaningfully lower, as wages are starting to crack and rollover at a faster rate.

This will eventually pull down inflation, as employment costs drop but it won’t be quick given the labor market backdrop.

These issues are finally bleeding into U.S. retail sales, which have been resilient until the end of March.

Our view was that retail sales really peaked at the beginning of March, and have been rolling over throughout that time period.

The data below supports that view, and as we head into key buying season with Summer travel, seasonally-speaking things will get worse.

“April retail sales +0.4% m/m vs. +0.8% est. & -0.7% in prior month (rev up from -1%)…

Sales ex-autos +0.4% vs. +0.4% est. & -0.5% in prior month…

Sales ex-autos & gas +0.6% vs. +0.2% est. & -0.5% prior…

Control group (matters for GDP) sales +0.7% vs. +0.3% est. & -0.4% prior.”

“Looking at retail sales in year/year % change terms, the gain in April was the slowest since May 2020.

Trend in retail sales continues to soften, with 6-month % change down into negative territory as of April though not yet in clear recessionary territory.”

It’ll be interesting to see what happens in the summer months.

Thanks for reading,

Freedom Financial News