- Why is the demand for diesel declining?

- U.S. imports have reached a four year low

- OPEC production likely to drop 60,000 barrels a day

Dear Reader,

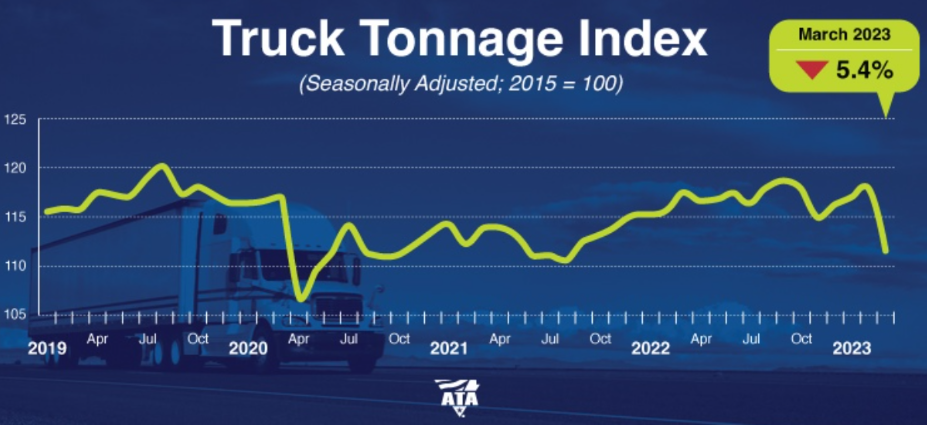

The U.S. is seeing a sizable drop across the truck tonnage index, which supports all of the underlying data we have seen to date.

This also points to renewed declines across the diesel demand levels heading into summer.

And between a drop in exports and slowing internal demand – we see more downside risk on distillate crack spreads and builds rising.

When we look further out in the shipping supply chain, we don’t see it getting any better.

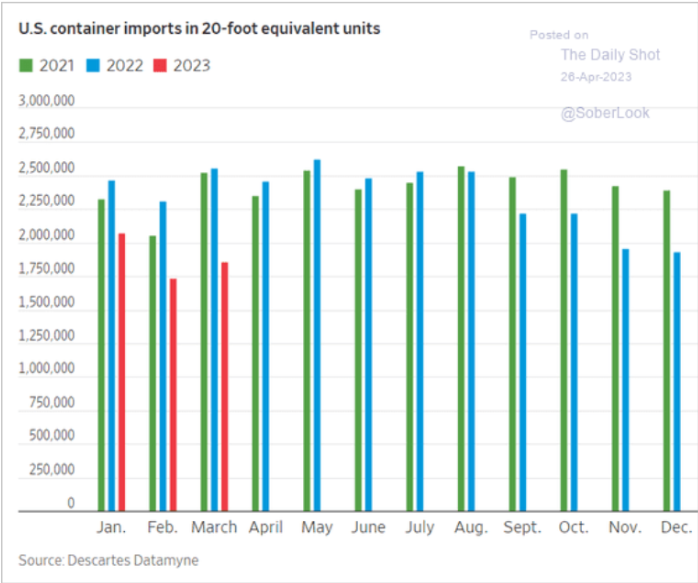

U.S. Imports Have Fallen Below 2019 Levels

The imports into the country have fallen well below ’21 and ’22, and are actually below 2019 levels – one of the first places we got bearish prior to COVID.

A lot of the key export/trading indicators are supporting this additional slowdown as well.

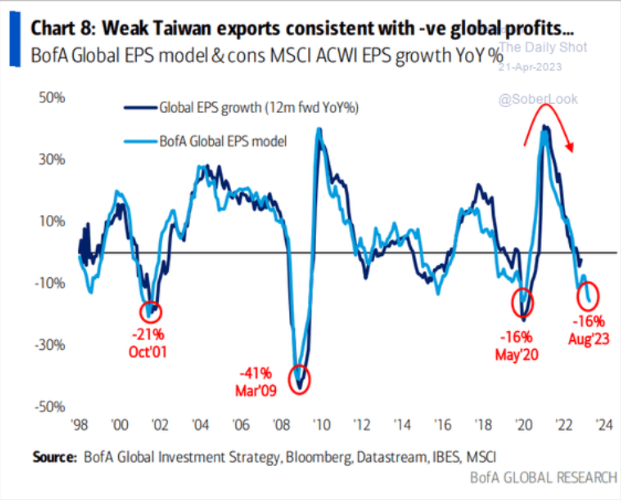

Taiwan, South Korea, Japan, and China are great bellwethers for global trade, and all of them have shown a broad reduction in flows.

Below is the most recent breakdown of Taiwan exports, and the broad ranging slowdowns coming from the country.

When we factor in the current pricing, you can see there is another rerating coming on the trucking front.

According to Craig Fuller, CEO of FreightWaves:

“The spread between contract and spot rates is near all-time highs at -$.92/mile.

It is almost a dollar cheaper to ship a truckload through the spot market than it is to ship it in the contract market.

These two markets are fungible. Contract rates have a lot further to fall.”

OPEC Production Likely To Drop 60,000 Barrels a Day

When we look at current production levels of OPEC+, early indications are a small drop of 60k barrels a day for April.

Nigeria and Iraq led the declines, offsetting a jump in Saudi Arabia, market intelligence firm Kpler said in a report.

- Nigeria declined by 240k b/d to 1.05m b/d

- Iraq dropped by 230k b/d to 4.2m b/d

- Saudi Arabia increased by 360k b/d to 10.6m b/d

As we have been highlighting, Nigeria is struggling to sell crude, so it isn’t surprising to see a drop in production again.

Iraq is still struggling because they can’t get crude through the Ceyhan pipeline, which is resulting in a drop in flow.

Essentially, Iraq is already producing at what they agreed to on May 1st while Saudi ramped it up ahead of next month’s cut.

This is why we don’t believe the “total cut” next month will be underwhelming given the current flows.

Russia has also announced a “pause” in the publishing of crude, refined product, and condensate data.

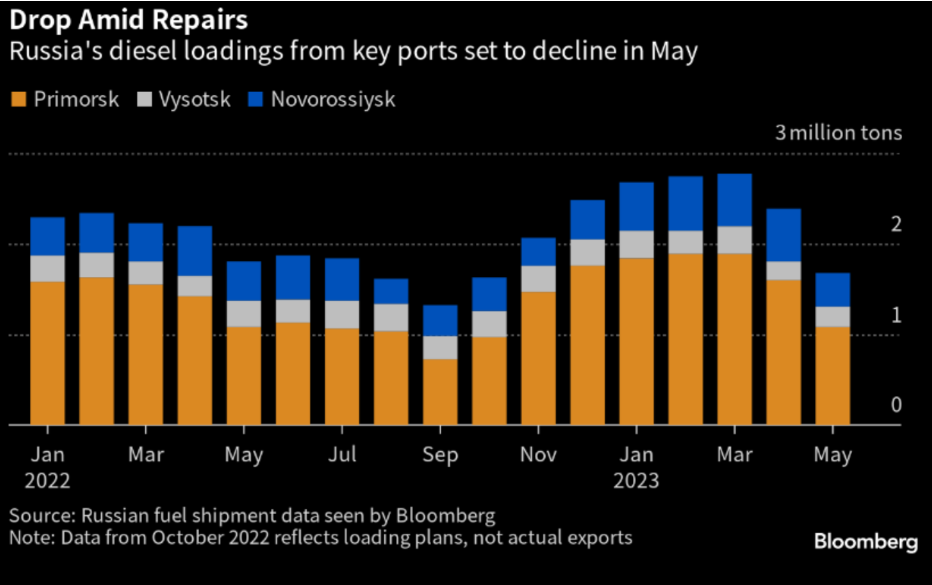

Ahead of that stop, Russia published a sizable drop expected in diesel exports in May.

“Sharp declines in the May flows happen every year, but the plans for the month are visibly below the seasonal norm.

Russia pledged to cut its oil production by about 500,000 barrels a day from last month, but the curbs have yet to materialize in most official data.

A major decrease in diesel shipments would offer a hint that the output reductions are starting to be felt.

Loadings of the fuel from Russian ports in the Black and Baltic seas, some of which originate in Belarus, are planned at 1.67 million tons next month, according to industry data seen by Bloomberg.

That’s equivalent to more than 400,000 barrels a day, a 32% decline from the daily April loading plans, and well below the same month last year, Bloomberg calculations show.”

This may seem like a problem, but there are about 5M barrels of Russian diesel floating in the market that are struggling to find a home.

“The projected May volumes are below the seasonal norm of about 600,000-650,000 barrels for the ports in question.

Diesel shipments from the three locations exceeded 790,000 barrels a day so far in April, staying roughly at the same level as at the start of the year, according to Kpler.com.

Seaborne diesel flows have been robust in the past several months despite sanctions, which ban nearly all imports of its petroleum products by the European Union.

Russian oil firms have been able to find new customers, with much of the diesel-type fuel now heading to Turkey, North Africa and Brazil.”

Even with these run cuts, we don’t see the market improving from a crack spread or storage perspective.

It also puts into context why the cuts next month won’t be as severe as was initially expected, and more inline with our expectations.

It also puts into context why the cuts next month won’t be as severe as was initially expected, and more inline with our expectations.

Thanks for reading,

Freedom Financial News