- What does it mean for borrowing, lending and spending?

- Prepare for another rate hike in June

- Global economic data remains mixed with some warning signs

Dear Reader,

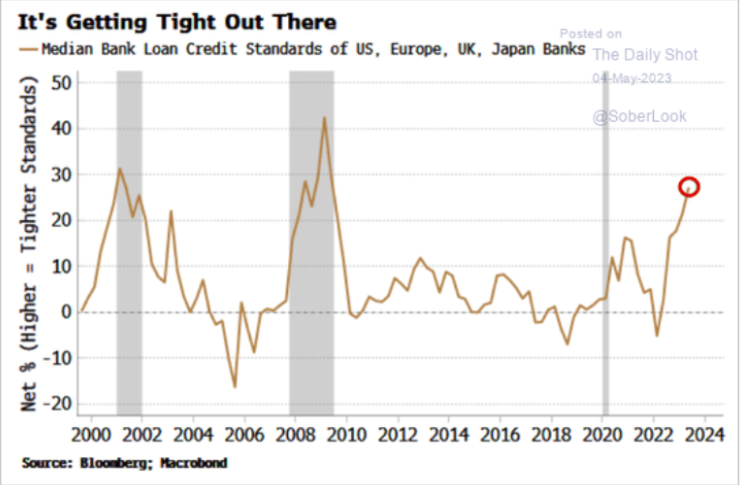

The chart below shows an example of the tightness we are seeing in the market regarding credit standards. The higher the percentage, the tighter the standards:

None of this is positive for borrowing, lending, corporate spending and investment, or just general economic activity.

The leading indicators show that lending conditions are only going to get tighter.

We agree with this view that banks will continue to tighten lending standards, which will only slow economic activity further.

One of the biggest “surprises” that is going to be baked into the market over the next few weeks is the Fed raising rates another .25bps.

The Case for Another Rate Hike In June

Right now – the market believes the Fed won’t do anything in June, but as inflation data continues to run hot – I think another quarter point is very likely.

This is the case for another rate hike in June.

Below gives you an idea of expectations:

“Per CMEGroup FedWatch Tool, expectations are now 98% no change at June FOMC meeting (2% for rate cut).”

People are delusional if they actually think there could be a cut.

I still think the market is underestimating the Fed’s resolve to keep rates elevated for an extended period of time, even as more regional banks struggle.

The banking sector stress is far from over – we will discuss this more next week.

Global Economic Data Remains Mixed

Global economic data remains mixed with some bright spots and other warning signs, but it all still points to a broader slowdown.

The problem is, it also supports an inflationary backdrop that will keep Central Banks either raising rates, or at least maintaining the current rate hikes for much longer than the market expects.

For those that have been following us, our base case has been sticky inflation and a stagflationary backdrop impacting economic growth.

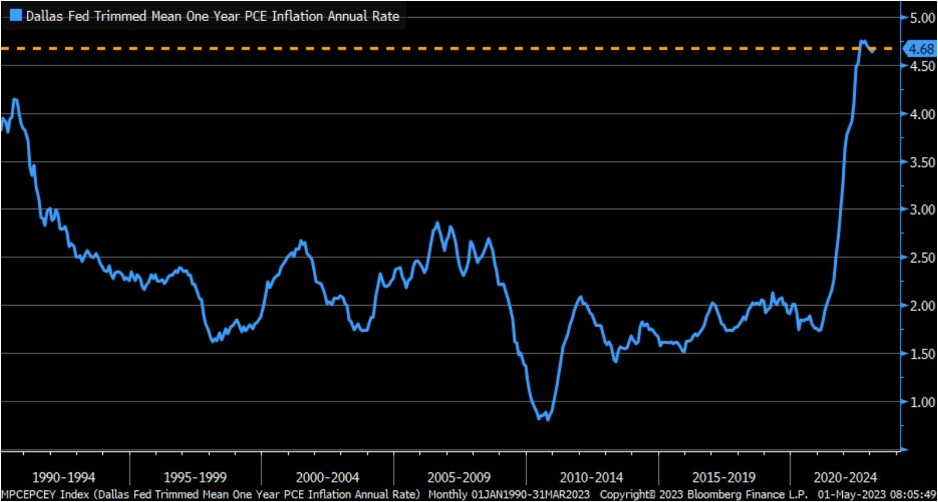

We had a broad reacceleration of inflation in Q1’23 with more follow through so far in Q2’23.

“Trimmed Mean PCE from Dallas Fed (year/year % terms) has reaccelerated since start of year … thru March, annual rate rose to +4.68%.”

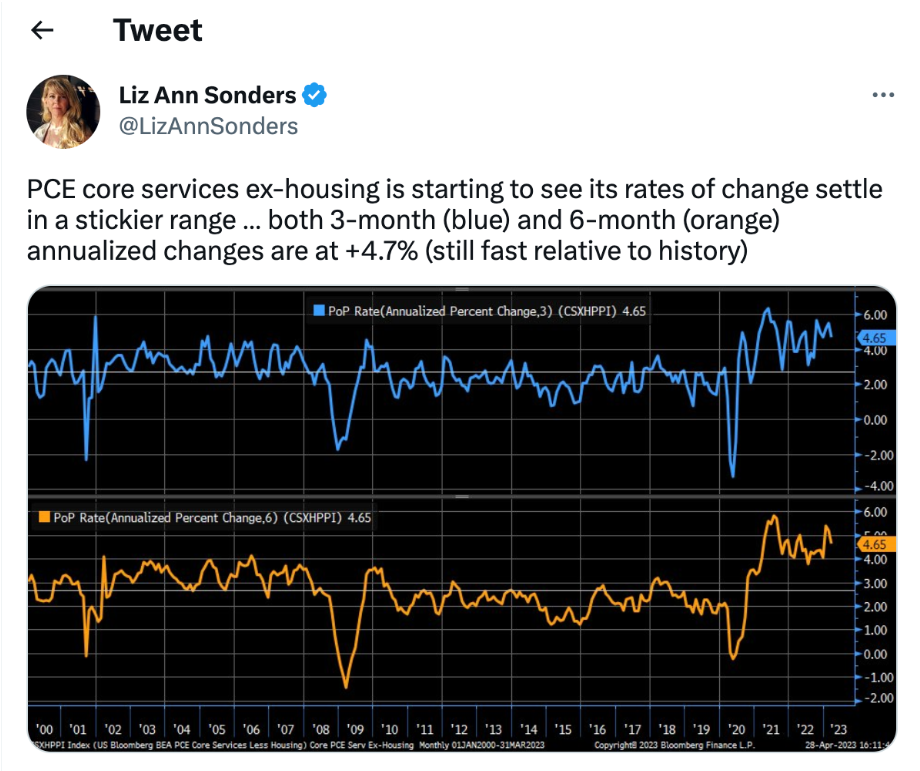

Our view was that services were going to be the “stickiest” component of inflation, and it would impact the broad market more than manufacturing.

Consumer spending and activity makes up about 70% of U.S. GDP, with service spending making up about 75% of that number.

This is why we spend so much time looking at different indicators impacting consumption, and how credit, income, and other factors will shift the broader consumer.

According to Liz Ann Sonders, Chief Investment Strategist for Charles Schwab:

“PCE core services ex-housing is starting to see its rates of change settle in a stickier range … both 3-month (blue) and 6-month (orange) annualized changes are at +4.7% (still fast relative to history).”

This just shows that things impacting consumers still remains a broad problem that is far from abating.

Refiners in China Are Operating At Reduced Rates

Chinese driving activity remained robust and dipped along seasonal norms, and right now refiners in China are operating at reduced rates.

They are pulling forward a large part of their purchase, which is going to cause a bigger problem as we head into summer.

There is a big expectation that this level of Chinese purchases will carry into summer, but that doesn’t look very likely at the moment.

The important point to watch will be export quotas and Asian gasoil cracks.

If China maintains current buying rates, we expect a big spike in export quotas, depressing crack spreads and forcing other Asian refiners to reduce…

Or we will see a smaller export quota and a big step back in Chinese buying.

This will be a very interesting dynamic to track as we progress through May.

Global driving still remains depressed, and we are seeing some sizable builds in gasoline around the world.

Gasoil cracks still remain the key driver of refiner activity.

We have had some sizable builds in Singapore and Europe over the last few weeks, which remains a big concern as we head into summer.

Gasoline/light distillate is either at a record, or at 2020 levels, while middle distillate/gasoil is moving back towards the “long term” average.

There was a bit of positive news coming from ASEAN manufacturing data showing some acceleration in activity.

Seasonally, we normally get a bump, but the important thing will be the follow through, which we still don’t expect given the rates.

Thanks for reading,

Freedom Financial News